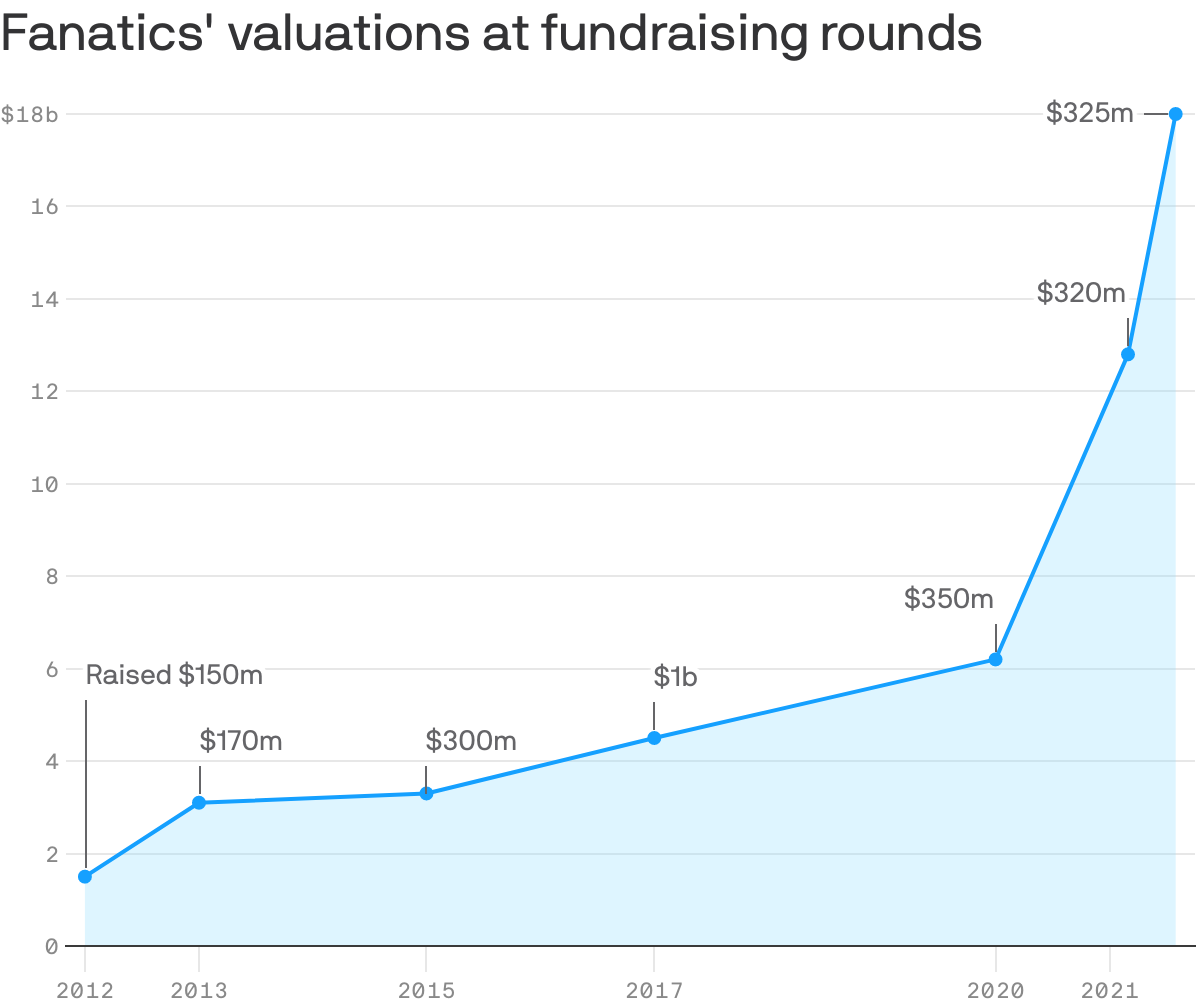

Data: CrunchBase; Chart: Connor Rothschild/Axios

Fanatics has nearly tripled in value over the last year. Now, the e-commerce giant wants to expand into new businesses like sports betting, ticketing and media.

Driving the news: Fanatics closed a $325 million funding round last week that values the company at $18 billion, making it the world's 12th-most valuable private company, per CB Insights.

The top 12 include:

- Bytedance ($140B)

- Stripe ($95B)

- SpaceX ($74B)

- Klarna ($45.6B)

- Instacart ($39B)

- Revolut ($33B)

- Nubank ($30B)

- Epic Games ($28.7B)

- Databricks ($28B)

- Rivian ($27.6B)

- FTX ($18B)

- Fanatics ($18B)

How it works: Founded in 1995, Fanatics achieved "decacorn" status ($10+ billion valuation) by controlling the sports apparel supply chain. Jersey sales go through them, period. And they don't just sell clothes — they make them, too.

- As the official retailer of licensed merchandise for many U.S. sports leagues and universities, Fanatics generates ~80% of its revenue from sales on Fanatics.com and the 300+ team and league sites it operates, per WSJ (subscription).

- Now, it will expand far beyond that, creating new products to further monetize its database of 83 million sports fans. After all, the people buying jerseys are the same people buying tickets and placing bets.

- In June, Fanatics formed an NFT company called Candy Digital and hired former FanDuel CEO Matt King to run its betting operations. Now, it's launching Fanatics Sportsbook.

The bottom line: Fanatics will eventually go public. Until then, there appears to be one goal as a private company: Try to take over the world.